Technical Staff

January 25, 2024

As an ongoing commitment to raising decision makers’ awareness about fraud and corruption risks, The American Anti-Corruption Institute (AACI) provides a list of the top ten fraud and corruption red flags along with recommendations on what management of small and medium-sized organizations can do about each one.

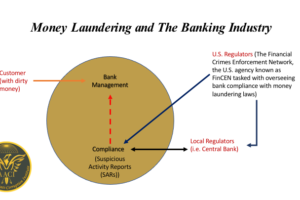

1. Unusual Financial Transactions

Red Flag: Frequent or unexplained financial transactions.

Action: Implement robust financial controls, conduct regular audits, and monitor financial statements for anomalies.

2. Lack of Internal Controls

Red Flag: Weak internal controls and oversight.

Action: Strengthen internal controls, segregate duties, and ensure a clear separation of duties among employees.

3. Employee Discontent or High Turnover

Red Flag: Widespread employee dissatisfaction or high turnover rates.

Action: Foster a positive workplace culture, encourage open communication, and address employee concerns promptly.

4. Inconsistent Documentation

Red Flag: Incomplete or inconsistent documentation.

Action: Establish clear documentation standards, conduct regular document reviews, and ensure compliance with record-keeping requirements.

5. Unexplained Lifestyle Changes

Red Flag: Sudden, unexplained improvements in employees’ lifestyles.

Action: Monitor employee behaviors, implement financial disclosures, and investigate any suspicious changes.

6. External Pressures

Red Flag: Existence of external pressures or influences on decision making.

Action: Train employees on ethical decision making, establish a strong ethical framework, and encourage reporting of external pressures.

7. Vendor and Supplier Relationships

Red Flag: Unusual relationships with vendors or suppliers.

Action: Implement due diligence processes for vendor selection, regularly review vendor relationships, and ensure transparency in procurement practices.

8. Inadequate Training and Awareness

Red Flag: Lack of anti-corruption training and awareness programs.

Action: Provide regular training on anti-corruption policies and procedures, and ensure employees understand their roles in preventing corruption.

9. Whistleblower Retaliation

Red Flag: Retaliation against whistleblowers.

Action: Establish a robust whistleblower protection program, encourage reporting, and investigate complaints promptly and impartially.

10. Ineffective Compliance Programs

Red Flag: Ineffectiveness of compliance programs.

Action: Regularly assess and update compliance programs, conduct internal audits, and ensure alignment with industry best practices.

Remember, these red flags and actions are general guidelines. Organizations should seek professional advice tailored to their specific circumstances to effectively combat fraud and corruption risks.

Caveat: The American Anti-Corruption Institute (AACI) does not provide professional advice through this blog post. The following information is intended to raise awareness among small and medium-sized organizations’ leadership about potential fraud and corruption risks. Organizations are encouraged to consult qualified professionals for specific guidance tailored to their unique circumstances.