October 31, 2020

Technical Staff

An ICIJ’s investigation has shown that major international banks facilitate money laundering for criminal organizations, politicians, and others. This investigation has generated reactions from many international actors as well as specific recommendations to increase the effectiveness of anti-money laundering. However, we want to clarify what we concluded about the significant weaknesses in the entire process of anti-money laundering, as revealed by this investigation:

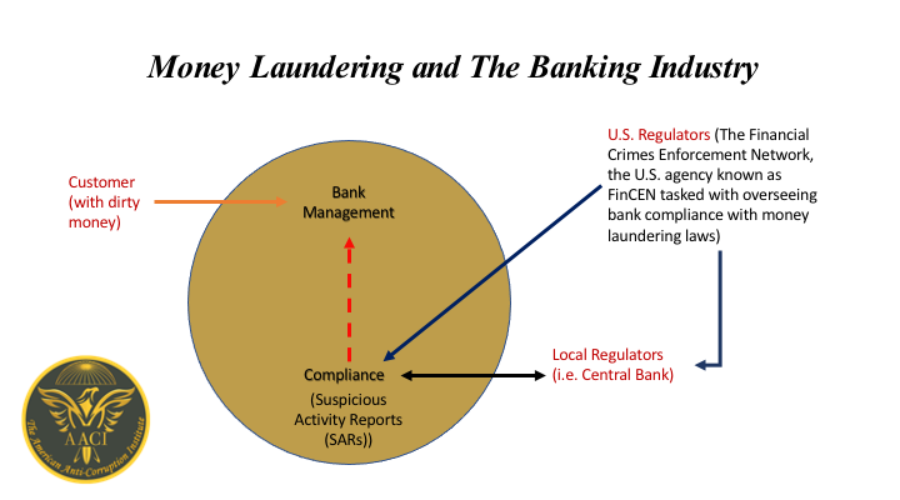

1- In many cases, a bank accepted check deposits or transfers from persons or entities without obtaining sufficient and appropriate information about them as required by the local laws or international regulators. As a result, this rendered the compliance department of the bank helpless and toothless. For example, when the compliance department attempted to prepare suspicious activity reports (SAR), they did not have the very basic information needed to complete the reports and inform the regulatory agencies.

2- When the U.S. regulators sanction a bank by imposing on it a big financial penalty and reaching a Deferred Prosecution Agreement (DPA), the sanctioned bank chooses and pays who shall monitor its compliance in accordance with the DPA. Therefore, it is evident why a sanctioned bank may continue facilitating money laundering to the corrupt and criminal networks! The sanctioned banks control the way they are being monitored and are ready to pay penalties that are a small bite of their mounting profits generated from moving the dirty billions of US dollars.

The Anti-Money Laundering System Is Broken

The revelations of the ICIJ’s investigation is the tip of the iceberg. The dirty money that is laundered annually is estimated to exceed three trillion US dollars. The anti-money laundering systems are ineffective and inefficient at both the local and international levels. It is inconceivable how the U.S. regulatory agencies can act on the flood of the SARs they receive daily from around the globe.

The investigation casts substantial doubts on the effectiveness of the compliance departments of the banks. Compliance officers ability to deter, prevent, or even detect suspicious banking activities are limited. They are not independent from the executive branch of the bank. The can only send SARs to the regulators and report internally to those who are concerned.

In addition, central banks, especially in developing or corrupt countries, are not as effective as they should be to play a proactive role in deploying a robust anti-money laundering regime. Currently, central banks deal with money laundering as a discrete criminal activity. They do not consider it as a part of the corruption pandemic. So central banks and international regulators are short sighted in their design and deployment of anti-money laundering regimes. As a result, money laundering flourishes where corruption prevails and fighting corruption is not a priority. Even when countries claim publicly their commitment to comply with FATF’s recommendations, they do not keep their promises.

The Ten Principles of Fighting Corruption

Besides the recommendations of ICIJ’s investigation, we believe countries should adopt the ten principles of fighting corruption. Mere compliance with rules and regulations is meaningless and will not deter, prevent, or detect money laundering. We expect local and international regulators to show more results in the fight against corruption.