A Practical Guide to Help Small Retailers Protect Themselves from Fraud and Corruption

By The American Anti-Corruption Institute (AACI)

May 16, 2025

Imagine this.

You run a modest but thriving cash-based retail store. Customers stream in daily. The register hums. You review the bank deposits weekly, trust a loyal employee with the cash box when needed, and rely on your accountant to keep things in order.

Until one day—without warning—the accountant vanishes. Along with a significant sum of your money.

This isn’t fiction. It’s a frequent reality for countless small business owners. Fraud and corruption don’t only haunt large corporations or governments—they hit small enterprises where it hurts most: cash.

At The American Anti-Corruption Institute (AACI), we work with organizations of all sizes, and we know that small retailers are especially vulnerable to financial misconduct because of limited staff, informality, and deep trust in individuals rather than systems. But awareness and practical steps can make a profound difference.

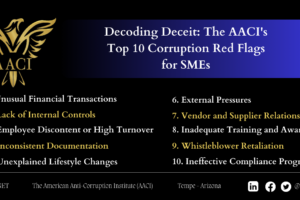

8 Red Flags You Should Never Ignore

These signs are often visible before the cash goes missing:

1. Missing or altered deposit slips

2. POS totals that don’t match actual cash in the drawer

3. Delays in depositing daily cash sales

4. Inconsistent recording by the accountant

5. One person handling cash and recording it

6. Lifestyle changes or unusual behavior from a trusted staff member

7. Customers complaining about not receiving receipts

8. Employees resisting oversight or avoiding reviews

If you recognize even two or three of these signs, you’re already in the danger zone.

8 Actions to Defend Your Business from the Inside

You don’t need a department of auditors or expensive consultants. You need discipline, routine, and awareness. Start with these:

1. Establish Simple Segregation of Duties

No one person should handle cash, record it, and reconcile it. Split responsibilities wherever possible.

2. Daily POS and Cash Reconciliation

At day-end, match the POS report with the actual cash on hand. Use a simple form to record any differences.

3. Bank Deposit Review Log

Personally sign off on each cash deposit. Compare it to daily POS sales.

4. Written Cash Handling Procedure

Just one page. It should say who does what, when, and how. Post it. Follow it.

5. Random Spot Checks

Surprise checks send a message: oversight is active and expected.

6. Customer Receipt Culture

Put up a sign: “Please collect your receipt. It’s your right.”

Teach customers to help you monitor integrity.

7. Red Flag Conversations

Train your team on what behaviors raise concerns. Make it part of your store culture.

8. Use Your External Auditor Smartly

Don’t treat the audit as a formality. Ask auditors to focus on your cash cycle.

We Know Prevention Works

At The AACI, we teach and train on the power of prevention over cure. The cost of implementing these measures is minimal compared to the financial—and emotional—cost of fraud.

Small business owners must understand that trust is not an internal control. Systems, visibility, and vigilance are.

Download Our One-Page Visual Guide

To make this easier, we’ve prepared a visual version of this guide you can print and post in your office or share with your team.

[Download the Anti-Fraud Cash Control Guide for Small Retailers]

Final Word

Cash-based small businesses are tempting targets for fraudsters—often insiders. But simple, consistent, and visible controls can build a culture of accountability and integrity.

Don’t wait until fraud knocks on your door. Prevent it from entering.

Follow us on LinkedIn

Visit us at: www.theaaci.net

Contact us: info@theaaci.com

Disclaimer

This guide is provided for general informational and educational purposes only by The American Anti-Corruption Institute (AACI). It does not constitute legal, financial, or professional advice and should not be relied upon as such. While reasonable efforts have been made to ensure the accuracy and relevance of the content, The AACI makes no representations or warranties, express or implied, regarding the completeness, suitability, or applicability of the information contained herein.

The implementation of any recommendations or practices described in this guide is at the sole discretion and responsibility of the user. The AACI shall not be held liable for any loss, damage, or adverse consequences resulting from the use of this material.

For professional guidance tailored to your specific circumstances, you are advised to consult qualified experts.