Technical Staff

March 10, 2024

Fraud and corruption remain persistent challenges in both the public and private sectors, undermining organizational integrity and eroding public trust. In our opinion, it is necessary to examine the multifaceted motives that drive senior managers or officers to engage in such misconduct. By comprehensively understanding these motives, we can develop more robust strategies to prevent and combat fraud and corruption.

1. Financial Gain:

One of the primary motives for fraud and corruption is the pursuit of financial gain. Senior managers may yield to the allure of embezzling funds, accepting kickbacks, or engaging in other illicit activities to enrich themselves personally. In the private sector, this often manifests in schemes to inflate revenues, manipulate financial statements, or misappropriate assets for personal benefit.

2. Power and Control:

The thirst for power and control is another significant motive driving fraudulent behavior. Senior managers may exploit their positions of authority to exert influence over decision making processes, manipulate outcomes, or consolidate their power within an organization. This drive for control can lead to unethical practices such as nepotism, favoritism, or the exploitation of subordinates for personal gain.

3. Prestige and Status:

In both sectors, individuals may be motivated by the desire for prestige and status. Senior managers may resort to fraudulent activities to maintain a façade of success or to enhance their reputation within their professional or social circles. This motive can drive individuals to engage in unethical behavior such as falsifying credentials, misrepresenting achievements, or engaging in deceptive practices to uphold an illusion of success.

4. Fear of Failure or Loss:

The fear of failure or loss can also serve as a potent motivator for fraud and corruption. In the face of economic uncertainty, organizational pressure, or personal insecurities, individuals may feel compelled to cut corners, bend rules, or engage in unethical behavior to avoid negative outcomes such as job loss, financial ruin, or reputational damage. This motive underscores the importance of fostering a culture of integrity and accountability within organizations to mitigate fear-driven incentives for misconduct.

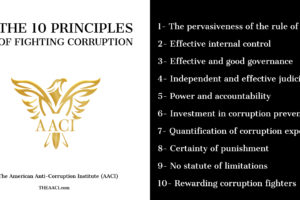

5. Ineffective Internal Control:

Weak or ineffective internal control mechanisms can create opportunities for fraud and corruption to thrive. When organizations lack robust systems for detecting and preventing misconduct, senior managers may exploit vulnerabilities for personal gain. Inadequate oversight, lax enforcement of policies, poor segregation of duties, and insufficient checks and balances can embolden individuals to engage in fraudulent activities with reduced risk of detection or consequences.

6. Poor Governance Practices:

Poor governance practices, characterized by ineffective board of directors or equivalent members, and deficiencies in transparency, accountability, and ethical leadership, can exacerbate the risk of fraud and corruption. When organizations fail to uphold high standards of governance, senior managers may exploit loopholes, circumvent regulations, or engage in collusion with external parties to further their personal interests. Lack of oversight from governing bodies, ineffective risk management processes, and inadequate whistleblower protection mechanisms can contribute to a culture of impunity where fraudulent behavior flourishes.

In conclusion, addressing the underlying motives behind fraud and corruption requires a multifaceted approach that encompasses financial incentives, power dynamics, social pressures, and institutional factors. By tackling issues such as ineffective internal control and poor governance practices alongside traditional anti-corruption measures, organizations can fortify their defenses against misconduct and foster a culture of integrity and accountability.

Sources

Image by Wilfried Pohnke from Pixabay