Mike J. Masoud

September 21, 2020

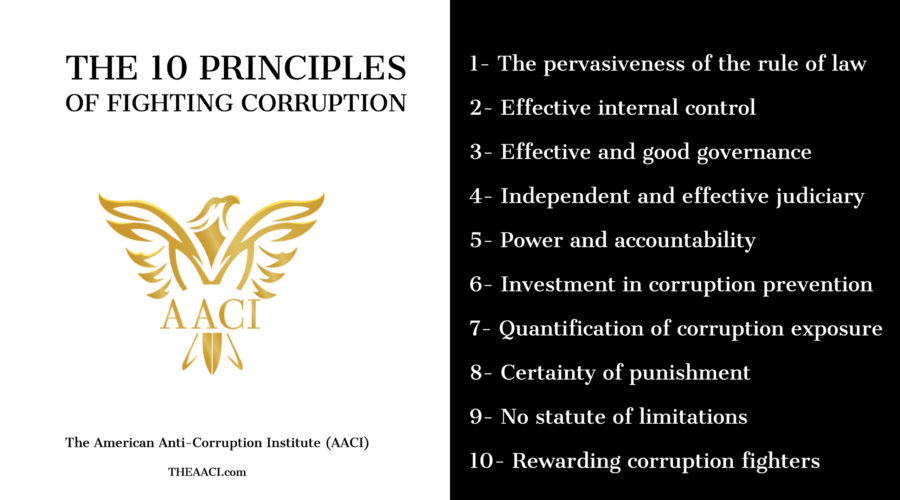

It is the third principle of the ten principles of fighting corruption. The following image shows these principles that form the benchmark for assessing and testing the effectiveness of fighting corruption strategies, policies, or plans.

The shortest and most inclusive definition of governance is “the system by which companies are directed and controlled.” Companies are directed and controlled by ownership, boards of directors, incentives, company law, culture, and other mechanisms. ”1 Those who are charged with governance approve the entity’s strategy and ensures that it has sufficient resources to achieve the strategic goals efficiently and effectively. They make sure that the entity has appropriate internal control systems to achieve the control objectives. Internal control systems must provide reasonable assurance that the entity’s assets are protected from loss, theft, or abuse. Though those who are charged with governance use internal control, budgeting, and other mechanisms to ensure they control the entity’s operations. But who are those who are charged with governance?

In a governance context, the board of directors (BOD) is synonymous with governance in the private sector as the BOD plays a central role in governance. In the public sector, we call it good governance, rather than calling it corporate governance, as we do in the private sector. They use governance mechanisms to achieve the governance primary objective: the welfare of society.

Governance Mechanisms

They consist of two classes:

1- Formal mechanisms. For example, corporate law, tax laws, and formal governance codes.

2- Informal mechanisms. For example, social values and norms, and corporate culture

In practice, both mechanisms are at play. They are also dynamic.

Misconceptions about Corporate Governance

- Corporate governance differs from corporate management. Management is concerned with its functions: organizing, planning, controlling, and directing the corporate’s resources to achieve the objectives of the corporate strategies. Therefore, functions such as sales, marketing, production, human resource management, financial management are not part of corporate governance. It is clear that good management and good investment decisions are crucial to good and acceptable performance.

- Corporate governance is not synonymous with the corporate governance code. Corporate governance code is a mechanism used to ensure proper implementation of acceptable governance practices.

- Corporate governance exists in every entity irrespective of size, nature, or industry. It is not limited to organizations that have boards. Family businesses and SMEs (Small and Medium-Size Entities) utilize corporate governance practices, regardless of their effectiveness.

- There is not one set of corporate governance practices that apply to every organization. As countries have different laws, social norms, and culture, their organizations also have their own. For example, when a developing country adopts the entire corporate governance practices of the United Kingdom, it risks developing and implementing adequate corporate governance practices for its institutions.

- Corporate governance is not static; it is dynamic. It does not end by adopting a set of agreed-on best governance practices: it is only the start. Changes are guaranteed in people ( board members, senior management, and employees), internal corporate culture, external culture, relevant and applicable rules, laws, and regulations, social norms, and many other variables. Those charged with governance should make sure that the currently approved and used governance practices adapt to those changes. 2

The Effectiveness of Governance

Whatever one cannot measure, (s)he cannot control and manage. So those who are charged with governance must measure governance to be able to assert on its effectiveness. Measurement can be qualitative, quantitative, or both.

Corporate Governance: Effective Implementation and Corruption Prevention

Good governance leads to good performance and plays a significant role in sustaining growth and lowering the cost of capital. It prevents and deters perpetrators from committing fraudulent and corrupt acts. The tone those charged with governance set at the top plays a crucial role in realizing the planned benefits of implementing best governance practices.

The effective implementation of a corporate governance code or best good governance practices requires, among many other things, an explicit commitment of those charged with governance and executive management. The mere compliance with regulatory governance requirements will not necessarily benefit companies.

Effective corporate governance requires effective internal control and effective corruption prevention policy. Governance, risk, and control (sometimes called GRC) are interrelated and interdependent. GRC are fundamental pillars in preventing, deterring, detecting fraud, and corruption. 3

Corruption and Governance Failure

In my view, weak governance systems provide opportunities for fraud and corruption. On the contrary, effective and well-designed governance systems lower corruption risks and deter fraudsters and culprits from committing their crimes.

But what weakens governance systems? What leads to governance failure? Who is responsible for governance failure? Who is accountable for weakening governance systems? These are complex questions that must be answered to understand the dynamics and significance of governance.

Citizens are Responsible for any Governance Success or Failure.

They can make or break any governance system. Citizens elect their public officials and must hold them accountable for their acts. They form the real power in any community to bring about necessary changes to the prevailing corrupt governance systems or practices. Citizens whose anti-corruption intelligence is adequate are more effective than those who do not have appropriate awareness about the interplay between governance and corruption.

Mike J. Masoud, The Sr. Director of The American Anti-Corruption Institute (AACI) in the Middle East and Africa. Email: Mike@THEAACI.com

End Notes and References

- Cadbury Commission, Code of Best Practice: Report of the Committee on the Financial Aspects of Corporate Governance, 1992, Gee and Co.: London

- The Exam Unit, The American Anti-Corruption Institute, LLC, CACM Review Textbook, page 377, 2020 Ed. Tempe – Arizona, USA.

- The Exam Unit, The American Anti-Corruption Institute, LLC, CACM Review Textbook, page 382, 2020 Ed. Tempe – Arizona, USA.