August 17, 2022

Technical Staff

The following story (click here to read it in its entirety) is a typical example of how kickbacks work, and how they begin small and grow larger and larger. On August 15, 2022, The Sunday Morning Herald published a story titled “Businesswoman gave car, boat, and holidays to NAB employee in kickbacks, court told.” As the case is still in court, our discussion is based in part on what the prosecutor stated in court, as published by the Sunday Morning Herald.

What does a “kickback” mean?

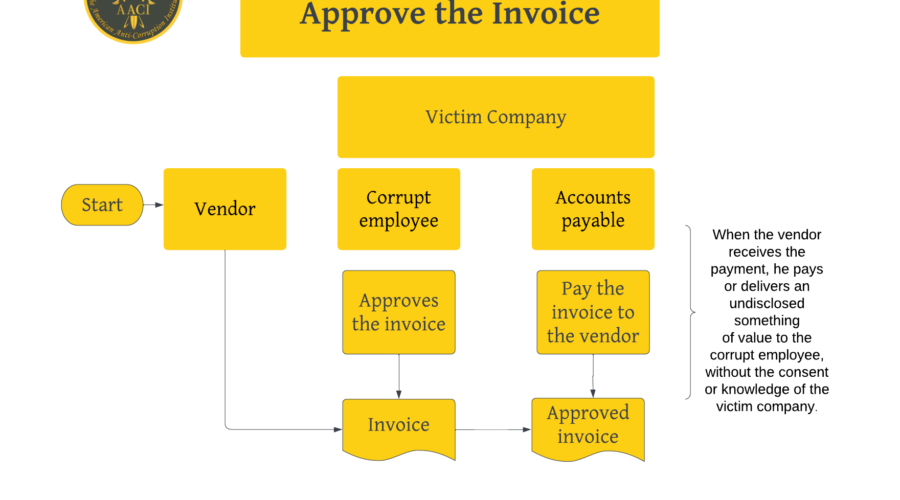

“Kickback occurs when a vendor pays or delivers an undisclosed something of value to a corrupt employee, without the consent or knowledge of the victim company or organization, to influence the corrupt employee’s decision in favor of the vendor.” 1

Helen Rosamond is the vendor. Rosemary Rogers is the alleged corrupt employee. National Australia Bank is the victim company. Over more than three years, Rogers approved more than 15 invoices for Human Group, the vendor’s company, worth tens of millions of dollars. In return, Rosamond gave Rogers “in excess of $2.5 million in corrupt benefits.”

Kickbacks: approve the invoice

The following diagram shows the basic process of a kickback scheme using a billing scheme. The diagram depicts the kickback definition as shown above. However, we want to identify three scenarios of the invoice that the victim company pays deceitfully:

Scenario 1: The invoice either has an inflated unit price and/or lower quantities delivered. However, the quality is as agreed on and the company requested the purchased items.

Scenario 2: The invoice either has an inflated unit price and/or lower quantities delivered. However, the quality is not as agreed on and/or the company did not request the purchased items.

Scenario 3: The invoice is fake. The company did not receive anything of value. The victim company is not aware of the entire transaction.

Whistleblowing is the Most Effective Mechanism to Uncover Corruption.

The AACI defines whistleblowing as follows:

“Whistleblowing is a deliberate non-obligatory act of disclosure that is made, following the rules and regulations of the applicable law, by a person or persons who have or had privileged access to data or information of an organization, about material illegality or other wrongdoing, whether actual, suspected, or anticipated, which implicates and is under the control of that organization, to an internal and/or external authorized person or entity having the potential to rectify the wrongdoing.”2

The American Anti-Corruption Institute (AACI)

Whistleblowing is the most effective anti-corruption detection tool. More than 50% of fraud and corruption cases are detected through tips.

Going back to the story, Rogers, who had been at the bank since 1995, was given the authority to approve payments up to $20 million. The corrupt relationship with Rosamond lasted more than three years. Where were the internal auditors, the external auditors, and the internal control system? The more senior the corrupt employee, the less effective the internal audit function and internal control.

An anonymous whistleblower alerted NAB to the pair’s arrangement, resulting in an internal probe and police involvement. Who knows how long it would take to detect such a corruption scheme without whistleblowing? Board members and executive management should invest in anti-corruption. Establishing a corruption prevention policy, that includes whistleblowing, would lower corruption risks and help board members and executive management meet their legal duties.

Sources

1. Exam Unit, “Principles of Fighting Corruption,” Certified Anti-Corruption Manager (CACM) Review Textbook, 2022 ed. (United States of America: The Exam Unit of The American Anti-Corruption Institute LLC., January 14, 2022) page 219.

2. Ibid, page 523.